Why ETFs Are a Smart Investment in 2025

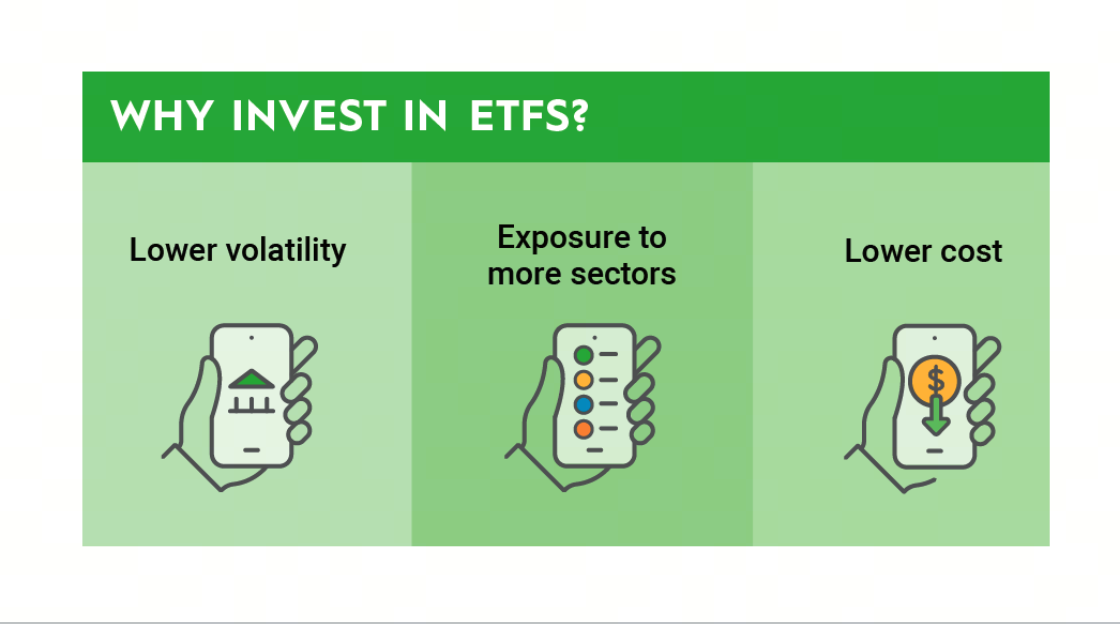

ETFs continue to attract investors due to their low expense ratios, tax efficiency, and the ability to trade like stocks. In 2025, several trends—including AI-driven innovation, green energy expansion, and inflation-resilient assets—are influencing ETF selection.

Key benefits of ETFs in 2025 include:

- Broad diversification with a single purchase

- Lower fees compared to mutual funds

- High liquidity, allowing intraday trading

- Access to emerging markets and sectors

Top 5 ETFs to Watch in June 2025

The following ETFs have shown strong performance, solid fundamentals, and are positioned to benefit from current macroeconomic trends.

1. Vanguard S&P 500 ETF (VOO)

- Category: Large-Cap Blend

- Expense Ratio: 0.03%

- Why It’s Top in June: Tracks the S&P 500, making it a staple for those seeking broad-market exposure. As the U.S. economy stabilizes, this ETF remains a core holding.

2. iShares Global Clean Energy ETF (ICLN)

- Category: Clean Energy

- Expense Ratio: 0.41%

- June Advantage: With rising support for sustainable energy initiatives, ICLN is benefiting from government policies and corporate ESG mandates.

3. ARK Innovation ETF (ARKK)

- Category: Disruptive Tech

- Expense Ratio: 0.75%

- Why June 2025 Is Crucial: Cathie Wood’s flagship fund invests in AI, genomics, and automation, aligning with 2025's tech boom.

4. SPDR Gold Shares (GLD)

- Category: Commodity/Gold

- Expense Ratio: 0.40%

- June Edge: A hedge against inflation and geopolitical uncertainty. GLD remains a safe harbor amid market volatility.

5. Schwab U.S. Dividend Equity ETF (SCHD)

- Category: Dividend

- Expense Ratio: 0.06%

- Why Investors Love It Now: High dividend yield combined with financially strong companies makes SCHD a smart move during periods of economic uncertainty.

Performance Comparison of Top ETFs (June 2025)

Below is a chart summarizing the year-to-date performance, expense ratios, and dividend yield of our selected ETFs.

| ETF | YTD Return (%) | Expense Ratio | Dividend Yield (%) |

|---|---|---|---|

| VOO | 11.2 | 0.03 | 1.5 |

| ICLN | 8.9 | 0.41 | 0.9 |

| ARKK | 15.6 | 0.75 | 0.0 |

| GLD | 7.4 | 0.40 | 0.0 |

| SCHD | 10.1 | 0.06 | 3.6 |

How to Choose the Right ETF for Your Portfolio

Selecting the best ETF in June 2025 depends on your:

- Investment goals (growth, income, hedging)

- Risk tolerance

- Time horizon

Growth-oriented investors may favor ARKK or ICLN, while conservative investors might lean toward SCHD or GLD for income and stability. Broad market seekers should consider VOO.

Key ETF Trends in June 2025

🔹 AI and Tech Dominate

Artificial Intelligence remains a primary growth engine, driving funds like ARKK into the spotlight.

🔹 Green Energy Resurgence

With continued emphasis on sustainability, ICLN and similar ETFs are seeing renewed interest.

🔹 Inflation Protection

ETFs like GLD are preferred by those looking to guard against currency devaluation and economic shocks.

Final Thoughts

June 2025 presents a unique opportunity for ETF investors to capitalize on strong economic themes and sector-specific momentum. From stable index trackers like VOO, to aggressive growth plays like ARKK, there's an ETF for every investor type.

Whether you're new to investing or looking to rebalance, consider adding one or more of these top ETFs for June 2025 to your portfolio to stay ahead of the curve.