Managing substantial wealth requires expertise and a strategic approach. Private wealth management advisors and firms offer personalized financial guidance to help individuals and families navigate the complexities of wealth preservation, growth, and transfer. Discovering the right advisor or firm can be pivotal in achieving your financial goals. Here’s a guide to help you understand the role of private wealth management and how to find the right fit for your needs.

1. Understanding Private Wealth Management

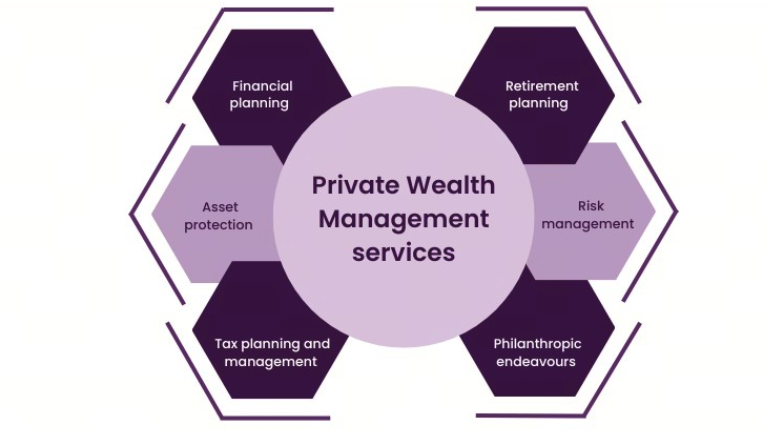

Private wealth management is a comprehensive service that addresses the unique financial needs of high-net-worth individuals (HNWIs). These services go beyond traditional financial planning, encompassing investment management, estate planning, tax optimization, retirement planning, and philanthropic advice. The goal is to create a holistic financial strategy that aligns with your long-term objectives and risk tolerance.

2. The Role of Wealth Management Advisors

Wealth management advisors are experienced professionals who provide tailored financial advice. They work closely with clients to understand their financial situation, goals, and preferences. Advisors create customized plans that include investment strategies, risk management, and estate planning. They also offer ongoing support and adjustments to ensure the plan remains effective as market conditions and personal circumstances change.

3. Benefits of Working with a Wealth Management Firm

Partnering with a wealth management firm offers several advantages:

- Expertise: Wealth management firms have a team of experts with diverse specializations, ensuring comprehensive advice across all financial areas.

- Resources: These firms have access to a wide range of financial products and services, including exclusive investment opportunities not available to the general public.

- Personalization: Firms tailor their services to meet the specific needs and goals of each client, providing a high level of customization.

- Holistic Approach: Wealth management firms integrate various aspects of financial planning, offering a cohesive strategy that addresses all facets of your financial life.

4. Choosing the Right Advisor or Firm

Selecting the right wealth management advisor or firm involves several considerations:

- Credentials and Experience: Look for advisors with relevant qualifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designations. Experience in handling clients with similar financial profiles is also crucial.

- Reputation: Research the firm’s reputation and track record. Look for client testimonials, reviews, and any disciplinary actions or complaints.

- Services Offered: Ensure the firm provides the services you need. Some firms specialize in certain areas, so it’s important to match their expertise with your requirements.

- Fee Structure: Understand the fee structure, whether it’s a flat fee, percentage of assets under management, or commission-based. Ensure it aligns with your budget and offers good value.

- Personal Fit: The advisor-client relationship is built on trust and communication. Choose an advisor who understands your values, communicates clearly, and makes you feel comfortable.

5. Top Wealth Management Firms

Several firms are renowned for their expertise in private wealth management. Some of the top firms include:

- Goldman Sachs Private Wealth Management: Known for its extensive resources and global reach, Goldman Sachs offers comprehensive wealth management services.

- Morgan Stanley Wealth Management: With a strong reputation and a wide range of services, Morgan Stanley caters to various financial needs.

- UBS Wealth Management: UBS provides personalized solutions and access to a vast network of financial products and services.

- Merrill Lynch Wealth Management: Part of Bank of America, Merrill Lynch offers robust financial planning and investment management services.

Conclusion

Finding the right private wealth management advisor or firm is essential for managing and growing substantial wealth. By understanding the benefits and considering factors such as credentials, reputation, services, and personal fit, you can select the right partner to guide you through the complexities of wealth management. With the right advisor, you can achieve your financial goals and secure your financial future.